The buyers guide to car finance

*Originally posted 23rd December 2015. The post has been updated to include more recent information.

Which Car Finance is right for me?

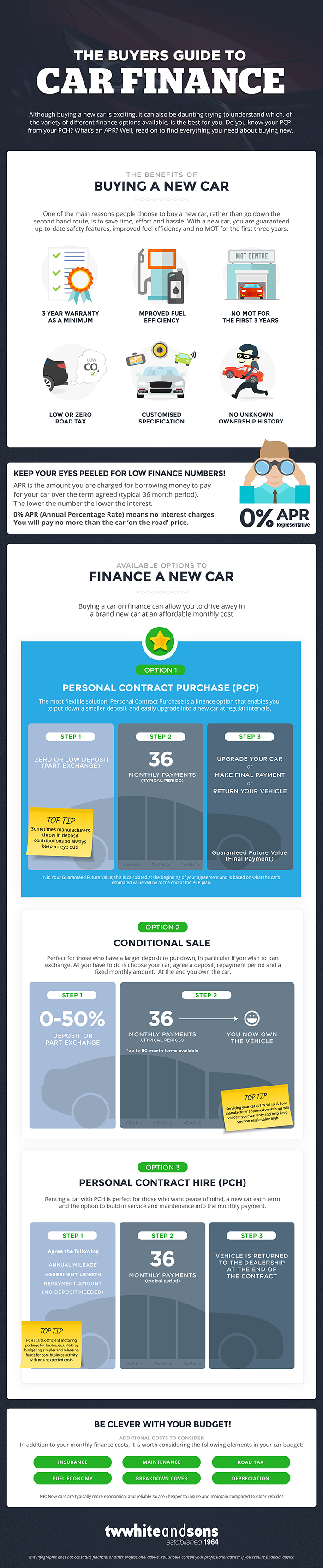

Buying a new car is an exciting experience for anyone, but it can quickly become a stressful one if you’re bombarded with car finance payment options and financial jargon that you’re not familiar with. Personal Contract Purchase, Hire Purchase, Conditional Sale, Contract Hire; unless you work in the motor trade these terms are likely to give you little to no idea of the finance option they cover. In fact, a recent study by RAC Flexiloan found that 72% of consumers simply go with the first finance option presented to them, while a quarter admitted they didn’t understand the finance option they’d agreed to.

The result of all this confusion and uncertainty is people picking the wrong finance option for them, and struggling to manage their monthly repayments. Here at T W White and Sons, we believe it’s vital that you understand exactly what you’re agreeing to, and we will always make sure we present you with all the options available so you can make an informed choice. But when you’re sat in the showroom, your dream car almost within your reach, it can be a bit much to take in. As such, we’ve put together this guide to car finance so that you can get to grips with the options.

Click the tabs below for more information on a specific finance option or view our Infographic to help you pick out the perfect car finance deal for your circumstances.

[tabby title=”Personal Contract Purchase”]

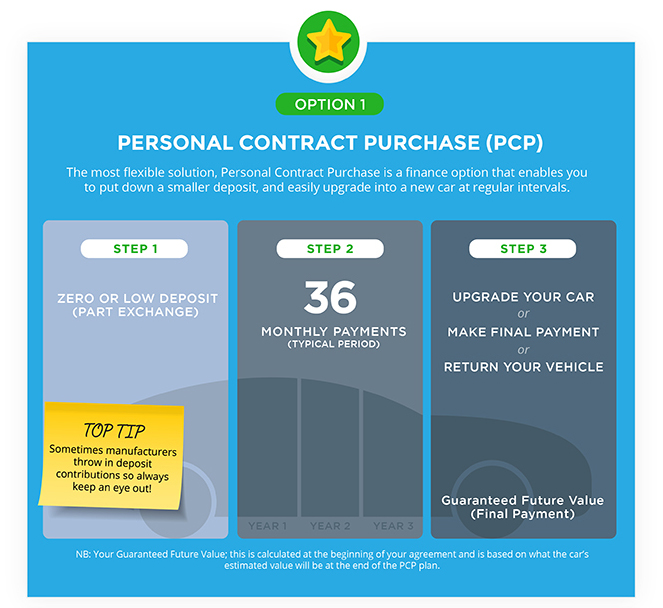

With more and more people looking for ways to bring down their monthly outgoings, there’s no surprise that PCP, or Personal Contract Purchase, has become the countries preferred new car finance option. Personal Contract Purchase is a finance option that enables you to put down a smaller deposit, and more easily upgrade into a new car at regular intervals, also monthly payments can be kept lower because there is an “Optional Final Payment” (often called a “Guaranteed Future Value”). If you are looking to upgrade your car more frequently this can be an extremely cost effective method for allowing you to do so. This option also offers more flexibility at the end of the agreement and protects your car’s future residual value.

How Personal Contract Purchase works:

STEP 1. Choose your next New Car or Used Car. If you have a car to part-exchange you can use this towards your deposit.

Once you have found a car, you will then need to estimate your annual mileage so that the finance companies can work out an “Optional Final Payment” based on the car’s predicted value at the end of the agreement. This final lump sum payment is also referred to as the Guaranteed Future Value.

STEP 2. We can then agree a monthly repayment amount including any interest you will pay (where applicable). We will organise all the paperwork on your behalf, and when you come to collect the car everything will be ready for you.

STEP 3. At the end of your agreement you will have three options:

- Buy another car using the difference between the value of your car over and above the “Optional Final Payment” amount as part of your deposit.

- Pay the “Optional Final Payment” and the car then belongs to you.

- Return your car without paying the “Optional Final Payment”. The difference between your car’s market value and the “Optional Final Payment” will be reimbursed to you.

[tabby title=”Conditional Sale (HP)”]

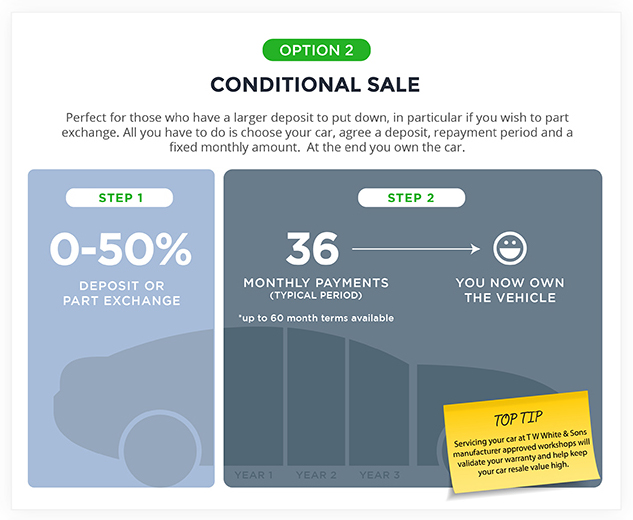

Conditional Sale (also known as Hire Purchase) is the traditional way to purchase your next car. When you buy a car on Conditional Sale you will own your vehicle at the end of the agreement. Payments are fixed, equal, regular instalments paid over a period of time which suits you. If you are looking to own the car and are unlikely to change your vehicle in the near future, this is an extremely cost effective method of paying for your next car.

How Conditional Sale (Hire Purchase) works:

STEP 1. Choose your next New Car or Used Car. If you have a car to part-exchange you can use this towards your deposit. Once you have found a car, we can then agree a deposit and repayment period.

STEP 2. We can then agree a monthly repayment amount including any interest you will pay (where applicable) We will organise all the paperwork on your behalf, and when you come to collect the car everything will be ready for you.

At the end of your agreement, when you have completed all repayments, you own the car. You can then keep the car, or you may be interested in then upgrading to a newer version, using your car as your next deposit.

[tabby title=”Contract Hire”]

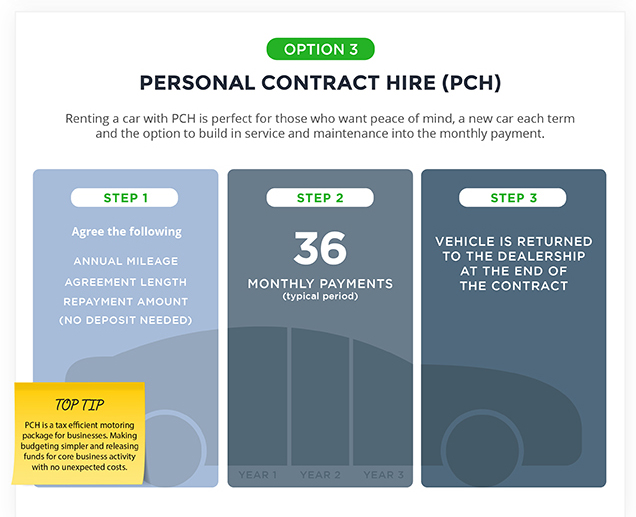

For business users, leasing a vehicle on Contract Hire through T W White & Sons is a simple and convenient process, offering you a non-maintained or fully maintained contract. Either way we will leave you free to spend more time concentrating on running your business. You don’t have to worry about depreciation, and you also don’t need to worry about disposal. Contract Hire requires no capital investment and allows you to minimise your risk.

Your company will pay for your car(s) through equal, regular instalments over a period of time which suits your company. Contract Hire helps to make your budgeting easier and there is no deposit required, giving you an additional credit line to release your funds for your core business activity.

How Contract Hire works:

STEP 1. Choose your business vehicle and whether you would like a fully inclusive motoring package including routine servicing, or whether you would like a non-maintained package – alternatively you can visit us in branch. If you have a car to part-exchange you can use this towards your deposit.

STEP 2. Once you have found a car we can then agree a repayment period and a monthly repayment amount including any interest you will pay (where applicable).

STEP 3. Vehicle is returned to the dealership at the end of the contract.

[tabbyending]

Similar Articles

Car Finance Explained – How Does Car Finance Work?

Investing in a new car is a big decision, so you want to ensure that you pick the purchase or finance option that’s right for you. You can buy a vehicle outright, but most people tend to opt for one of the finance options available. Car finance allows you to spread the cost of the […]

Buyers guide to pre-registered cars

While buying a brand new car might be alluring, and being the first driver registered to the car certainly has its benefits, it’s not necessarily the right choice for you. Before you make you decide, read our guide to pre-registered vehicles to see if it’s the best option for your needs. When it’s time to […]

The truth about average speed cameras

Dispelling the myths and misconceptions surrounding average speed cameras, we get down to the truth of how they work and how you can avoid getting fined. While we can all understand the need to monitor speeds from a safety perspective, no one like seeing the yellow of a speed camera in the road ahead. With […]