Things to notify your car insurance company of

Driving is all about adapting to change – whether that’s traffic conditions, grip levels on a wet road, or how different cars react to your inputs. But there are a certain number of changes that, according to your insurance company, are more important than others.

These alterations to circumstances – through your doing or completely passively – are the points you NEED to tell your insurance company about. If you don’t, you risk breaking the terms of your cover and could therefore be left without a pay-out following an accident.

From medical maladies to performance tweaks, here’s T W White & Sons’ guide on what you must notify your insurance company about.

MECHANICAL MODIFICATIONS

Anything from fitting new wheels to bolting a turbo onto your engine has to be declared to your insurance company – of course, some have greater implications for performance than others, likely meaning your premiums could rise due to the perceived increase in risk, so it’s important you declare all modifications.

While a new set of wheels might not make your car faster, they can attract more attention, increasing the possible risk of theft. Your insurance company will probably want more money for this as a result.

It might seem inconsequential, but running around with an undisclosed modified parts or parts on your car could mean you’re in breach of your insurance contract. If you had an accident, this could technically leave you uninsured, meaning you’ll have to pay for any damage out of your own pocket.

ELECTRONIC UPGRADES

Car stereos and speakers are easily stolen – all it takes is a smash-and-grab raid to rip wiring out of the dashboard and an opportunist thief has hit payday.

It’s this increased theft risk, or loss in case of damage or an accident, that insurers want to try and cover against. If you don’t tell them, they could refuse to pay for any repairs at all.

There’s a plus side though. Fitting an improved aftermarket alarm and/or immobiliser system increases vehicle security and hopefully decreases the risk of theft. You should see a drop in your cover costs if you make this modification, so definitely tell you insurance company in this instance.

In addition to saving money with an improved alarm, you could also save money on your insurance premium when you install a dashcam. Dashcam footage can be used to demonstrate that you’re in the right should you be involved in the event of a non-fault accident.

MEDICAL CONDITIONS

Some medical conditions mean your driving licence is restricted for a certain length of time – at which point, pending medical approval, your licence will be renewed.

Declaring a newly diagnosed or existing medical ailment might not increase your insurance premium, as you will have been passed fit to drive by a professional, but it is important your cover providers know for reference.

CHANGE OF ADDRESS OR CONTACT DETAILS

This is an obvious one – if the wrong address is on the policy, none of the documentation or policy updates will reach you.

But further to this, it could again mean you’re technically in breach of your policy’s rules, potentially giving the insurance company an opportunity to wriggle out of a claim following an accident.

It’s best to keep everything completely above board – there will be a grace period if you’re moving house for example, but be swift about notifying who ever you are with about a change of address.

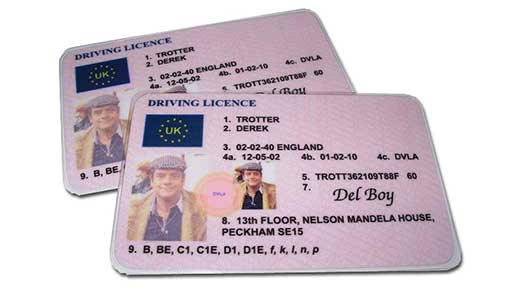

MOTORING CONVICTIONS

If you’ve been caught by the police for a motoring transgression, you WILL have to notify your insurance company of the conviction – and they’ll be more strict about the timeframe you have to do it in than if you need to change address, for example.

It will almost certainly result in an increase in cover costs, too. Some insurers turn a ‘blind eye’ to standard speeding tickets, for example, giving you one more chance before they increase your annual rate, but for bigger infringements such as no insurance or drink-driving, expect to have to fork out a whole lot more cash for your motor cover.

DRIVING ABROAD

As we outlined in our driving abroad guide, if you’re crossing the channel in your car it’s imperative you let your insurance company know.

Due to terms in your policy, your level of cover may change once you hit foreign soil, so as much for your benefit as theirs, pick up the phone and tell them where you’re going.

STOLEN VEHICLES

It sounds simple, but if your vehicle has been stolen, notify your insurance company as soon as possible. First you’ll have to tell the police, giving them the vehicle’s details and receiving a crime reference number in the process.

You’ll then be able to pass this on to your insurance company – it’s a terrible situation to be in, but being as helpful and as tolerant as possible here will help when it comes to receiving a pay-out somewhere down the line.

NO CLAIMS DISCOUNT

If you have no claims bonus you can carry over from another policy, tell your insurance company – it could help dramatically reduce your premium.

ANY OTHER CHANGES

It can prove highly annoying, but you should really tell your insurance company about even the most minor changes in circumstances. This falls under ‘Duty of Disclosure’ rules.

When you took out your policy, there will likely have been a clause which stipulated something along the lines of ‘it is your responsibility to inform us of any changes that may affect your policy’ – it’s more to cover the insurance company’s backs, but you wouldn’t want to be left without the proper cover.

Have any of the above points affected your car insurance? Maybe you have a few points to add to our list? Why not let us know on Twitter @twwwhiteandsons, or on our Facebook page? Alternatively, join in the conversation below.

Similar Articles

Car Finance Explained – How Does Car Finance Work?

Investing in a new car is a big decision, so you want to ensure that you pick the purchase or finance option that’s right for you. You can buy a vehicle outright, but most people tend to opt for one of the finance options available. Car finance allows you to spread the cost of the […]

Buyers guide to pre-registered cars

While buying a brand new car might be alluring, and being the first driver registered to the car certainly has its benefits, it’s not necessarily the right choice for you. Before you make you decide, read our guide to pre-registered vehicles to see if it’s the best option for your needs. When it’s time to […]

The truth about average speed cameras

Dispelling the myths and misconceptions surrounding average speed cameras, we get down to the truth of how they work and how you can avoid getting fined. While we can all understand the need to monitor speeds from a safety perspective, no one like seeing the yellow of a speed camera in the road ahead. With […]